CSA-Images | Vetta | Getty images

Lessons From Teacher Pensions

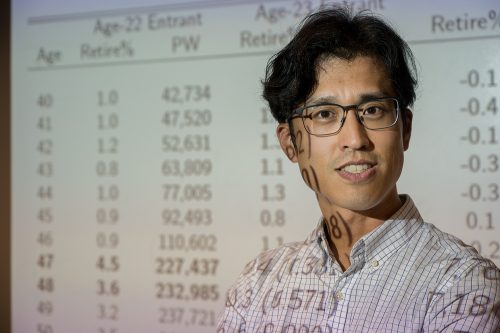

Dongwoo Kim does the math on retirement and retaining educators.

Even before Covid-19 burnout prompted some teachers to retire earlier than they’d planned, Dongwoo Kim had been researching how better retirement savings options could stem such career departures.

Kim, an assistant professor of economics, has co-authored three recent peer-reviewed papers on how pension plans help — or hurt — the retention of public employees.

The pandemic has made Kim’s research more relevant. From August 2020 through February 2021, midyear retirements surged 44 percent in Michigan public schools over the year-earlier period, according to state data reported by Crain’s Business Detroit. In Texas, early retirements of teachers, support staff and administrators rose 28 percent for the September 2020 to May 2021 period, compared with the previous school year, state data show.

Most teachers participate in state-managed pension plans, which provide regular, defined benefits after retirement, but 40 percent are excluded from collecting Social Security benefits.

States usually have one pension plan covering educators and support staff. For retention, that means a retirement plan is unlikely to keep a teacher from jumping in-state to another district. On the flip side, participating in a state retirement plan may dissuade some teachers from pulling up stakes for another part of the country, Kim said.

Dongwoo Kim, assistant professor of economics, said fewer teachers lead to bigger workloads for those who remain and reduce educational services for students. Photo by Leo Wesson

Kim examined state teacher pension plans from 2001 to 2015 to see how well their investment portfolios weathered ups and downs over time. In many cases, plan managers, feeling increased confidence from boom times, overestimated the rate of investment returns and found they could not meet their financial obligations.

State plans can increase benefits to adjust for inflation but not reduce them. To stem the financial losses, some states created tiers, which offer lower benefits for newly hired teachers while keeping better benefits for veteran teachers.

Education authorities responded to the instability of pension funds not by reducing teacher salaries but by culling the workforce. As a result, “salary expenditures are reduced when pension costs rise,” Kim and his co-authors wrote in the 2021 article “The Trade-Off Between Pension Costs and Salary Expenditures in the Public Sector,” published in the Journal of Pension Economics and Finance.

Fewer teachers lead to bigger workloads for those who remain and reduce educational services for students, Kim said.

In another 2021 study, Kim explored nontraditional benefits that might keep public school educators in the classroom longer. Most U.S. districts are required to participate in their state’s pension plan for teachers, so administrators are restricted from experimenting with alternate retirement plans.

Kim and his co-authors focused on how late-career incentives, including cash bonuses and deferred-retirement option plans, might persuade high-need teachers — like those in science and mathematics — to keep shaping young minds.

They tracked 2,131 Missouri science and math teachers between ages 48 and 65 for three years starting in 2011. Their study projected that a $30,000 bonus to educators in their 31st year of employment would triple the number of teachers postponing retirement versus a $10,000 incentive.

Several states offer a deferred-retirement option, which permits teachers to collect their regular salary along with their pension, which is put into escrow while they are working. But in every case that the researchers reviewed, those options were not targeted to encourage specialized teachers to stay in the classroom.

Kim has proposed research on how providing Social Security benefits to Texas public school educators would affect the state’s teacher labor market.

Kim said he hopes his economic research will lead to improved retirement savings options and serve the public good.

His pension research struck a chord with Ryan Peterson, a journalist-turned-public schoolteacher now working on a doctorate in curriculum studies at TCU. “Kim’s research on predicting how a late-career bonus would help entice teachers to stay in the field is definitely eye-catching and something I think many teachers would like to see implemented,” Peterson wrote in an email.

“To be rewarded with a shaky-at-best future is disappointing to say the least. It will be continually hard to retain strong teachers and recruit competent new teachers to the craft until we start placing educators on the same compensation level as doctors and lawyers,” Peterson said. “Well-funded pension systems are a step in the correct direction.”

Kim is interested in exploring other ideas on teachers and pensions, such as how offering both Social Security and a state pension plan might affect attracting and retaining teachers.

Your comments are welcome

2 Comments

Just want to know more

Thank you

Related reading:

Research + Discovery

Miriam Ezzani Researches the Role of Educators in Ending Educational Inequality

Self-reflection and anti-oppressive practices help ensure all students have a chance to succeed.

Features, Research + Discovery

Cecilia Hill Brings Awareness of Mexican American History to Fort Worth Schools

Texas schools have an opportunity to embrace a culturally diverse history curriculum.

Alumni

Joe Adcock Fights for Children

The detective tracks down predators and stands by their young victims.