Andy Mitchell's Lantern Capital Partners acquired disgraced media mogul Harvey Weinstein’s company in 2018, including its 277 feature films. Photo by Rodger Mallison

Andy Mitchell Snags Weinstein Film Library

The alumnus used business intuition and a winning personality to become a major player in Hollywood finance.

For a Hollywood casting director, it would be a no-brainer to choose the warm, persuasive Andy Mitchell ’98 for the role of a movie mogul over the famously brutish Harvey Weinstein.

Three years ago, no one in the entertainment industry had heard of Mitchell. And, of course, no one now wants to know Weinstein, the convicted serial rapist whose studio’s assets were acquired by Mitchell in a deft 2018 maneuver that jolted the entertainment world.

Mitchell is the founding CEO of Lantern Capital Partners, a Dallas-based private equity firm whose portfolio ranges from a Bermuda-based shipping line and a zinc recycler to a Tiger Woods-designed residential golf club near Houston.

What these once-distressed ventures had in common was the determination of Mitchell and his Lantern partners. They believed in the companies’ potential to grow to long-term profitability with improved management.

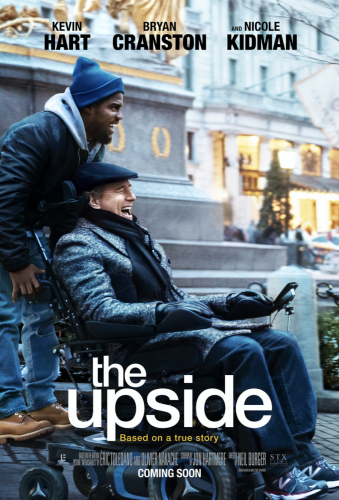

Andy Mitchell’s company acquired The Upside, which grossed $122 million worldwide and received mixed reviews from critics. Courtesy of Lantern Entertainment

Lantern wrested control of Weinstein’s Oscar-spangled film library and then scored a hit with its very first release. After snipping expletives to attain a PG-13 rating, The Upside with Bryan Cranston, Kevin Hart and Nicole Kidman grossed more than $100 million on a $37 million production budget.

Mitchell said he has little doubt that his accounting and finance studies at TCU, compounded by campus leadership roles, put him on a trajectory that led to pulling off the epic Weinstein deal.

The President

The start of his academic career at TCU was not so auspicious. Mitchell, who is from Benbrook, Texas, said his first semester grades at TCU were so poor that fraternity Lambda Chi Alpha deferred his acceptance. Switching to accounting and finance from pre-med studies, he righted the ship and later became Interfraternity Council president.

Almost by accident, Mitchell ran for student body president. He had come to the student government office to make a complaint, but student Kevin Nicoletti ’99 (MBA ’13) headed him off by saying: “I assume you are storming in here to put your name in for student body president.”

“Absolutely. That’s why I am here,” Mitchell improvised. (“To this day I still laugh about it,” he says now.)

Mitchell came out on top in a six-way race and then won the runoff. Unexpectedly, the TCU Daily Skiff endorsed him. He had built rapport with a range of campus groups by playing video games with international students and football players.

“When he ran for president, a lot of the Skiff staff didn’t know much about him,” said Ryan Rusak ’98, then the student paper’s editor and now opinion editor at the Fort Worth Star-Telegram. “We thought those in student government were out of touch, cliquish, and they had a lot of money to spend.

“Andy came in and told us, ‘This is what I am going to do: 1-2-3.’ He was way more open, transparent. Kind of blew us away.”

Using money smarts, Andy Mitchell snagged the Weinstein film library. Photo by Rodger Mallison

Before Mitchell, the son of a railroad switchman, took office, his mother found a job in TCU’s Office of International Services, which meant a tuition-free senior year for him. Student loans paid his living expenses. Money for socializing and gas for his beater Jeep was covered by hanging drywall, bartending, parking cars and waiting tables.

The academic move to the Neeley School of Business proved to be a wise one. The self-described accounting nerd would record lecture notes, then play them back during chores and, for some reason, while sleeping. The effort resulted in straight A’s.

“You’re in college to learn, to be successful, and you’re there to make connections with people, make partnerships,” he said. “I met [former] House Speaker Jim Wright — he called me Mr. President. Can you imagine what that feels like to a 21-year-old? I met Van Cliburn, got to know Chancellor Tucker.”

Don Mills ’72 MDiv, then vice chancellor for student affairs, had Mitchell sit beside him at gatherings where student concerns were aired. “Andy was outgoing, easy to get along with. He was one of the students whom we’d ask to make presentations to trustees,” said Mills, now a distinguished professor of higher education at TCU. “With Andy, there always was a sense he was going to reach as high as he could in whatever he did.”

The Ascension

After graduation, Mitchell built a business résumé and reputation at PriceWaterhouse Coopers, the investment bank Houlihan Lokey, capital manager Cerberus and then the Cerberus-controlled GMAC (later Ally). His biggest break came when GMAC asked him to fix its ailing resorts investment. The portfolio, acquired by Centerbridge Partners, was spun off as Lantern Asset Management in 2010 with Mitchell as CEO.

Five years later, he created Lantern Capital Partners in a deal paying $1 million to Centerbridge.

Mitchell and his team are always on the prowl for investments that offer them sufficient control to turn a struggling or collapsed venture into a profitable one. Lantern unlocks value in ailing companies by acquiring them at a workable price, making immediate changes and then, instead of selling for a profit, recruiting industry veterans to manage the ventures for the long haul.

Andy and Kristin Mitchell run the Lantern Family Foundation, an organization centered on connecting children with health care and education. Photo by Rodger Mallison

Partner Milos Brajovic spotted the Weinstein Co. opportunity and convinced Mitchell that it had all the right ingredients to fit their formula. The idea didn’t go down well at home. When told of the idea, Mitchell’s wife, Kristin, said: “You’re kidding me, right?”

Not only was the tainted name of Harvey Weinstein off-putting to her, she also knew the turnaround would be a long process that had to happen in Los Angeles. She said she relented because “I knew it was something he wanted to take on.”

Andy and Kristin Mitchell ’02, who live in Dallas, packed up their five children and rented an apartment in California.

The pair first met at a TCU Alumni Association event in Chicago. Mitchell was 29 and working at Houlihan Lokey. Kristin Kula, then 25, was employed by the British research firm Mintel. “He asked for my business card,” she said. “We took off from there.

“Andy doesn’t let anyone slow him down, and he gives me the same confidence,” she said. “We had talked about starting a foundation years ago, and last year Andy simply said, ‘Let’s do it,’ like he does with everything where I have self-doubt. And here we are with the Lantern Family Foundation, run by Andy and me. We have a huge heart for kids, [and] our mission is to enrich education, health care and well-being for children as well as military families.”

The Figuring

When the Weinstein Co. came on the market, Ron Burkle, a billionaire supermarket magnate, invited Lantern to consider joining his offer. But when Burkle prematurely announced that Lantern was part of his $500 million offer (with an additional $80 million for a fund for Weinstein’s victims), Mitchell said his company had not yet finished due diligence. The public announcement scuttled Burkle’s offer, forcing the Weinstein Co. into Chapter 11 bankruptcy two weeks later.

Films like Lion, which received six Oscar nominations, drew Andy Mitchell to his new film library. Courtesy of Lantern Entertainment

The drama was far from over. The bankruptcy court approached Lantern to be the stalking-horse bidder, meaning it would set the floor price against which other bidders could compete. Lantern put it at $310 million plus debt. The figure was based on Lantern’s calculation of the value of the 200-plus films in the company’s library, including Paddington, The King’s Speech, The Artist, Silver Linings Playbook and several Quentin Tarantino works. Mitchell estimated the collection would garner $400 million to $500 million over 10 years via DVD sales and licenses to TV streaming services like Netflix and Hulu.

But no competing bidder materialized at the April 6, 2018, auction. “There were other entities interested in buying Weinstein Co., but the deals disappeared or collapsed,” said Gene Del Vecchio, a former industry consultant who teaches marketing at the USC Marshall School of Business. “It is one thing to buy a healthy yet undervalued company, but the Weinstein Co. was snake-bit with scandal, lawsuits, layoffs, brain drain and debt.”

But Mitchell’s openness to opportunity and his ability to quickly assess a situation proved to be a winning combination. By the time the Weinstein Co.’s assets were up for grabs, the turnaround approach had been tested and perfected.

“Andy is a quick read … and doesn’t need a lot of data to make a decision,” said William Snyder, a Dallas-based veteran in the restructuring field. “He’ll never say, ‘Let me sleep on it.’ ”

Mitchell also has a knack for divining the other side’s threshold for pain. Lantern Capital Partners built its acquisition funds, he said, by raising “a couple of hundred million dollars” from the Kuwaiti social security system and a range of U.S. investment funds.

He and Brajovic also knew when to play hardball — and how. They gambled on just how much frustration the company’s negotiators could endure, extracting a dramatic eleventh-hour concession that reduced the eventual purchase price by millions as lawsuit threats flew.

“One of the characteristics that differentiates Andy from many of his counterparts is his 20 years’ expertise in turnarounds,” said Josh Governale ’98, a media adviser to Mitchell’s firm for years. “Andy knows bankruptcy law, and during the Weinstein deal he would often exhibit insights no one else had. This encyclopedic knowledge allowed him to navigate with clarity through this intense four-month process.

“Andy could be the smartest person in the room, but he didn’t behave like that. He was focused, an intent focus,” said Governale, who was in the L.A. war-room hotel suite as the Lantern negotiators executed their strategy.

Mitchell’s optimism kept morale up during times when the deal could easily have collapsed, Governale said. “Andy would say, ‘We’re going to get through this.’ ‘We’re getting closer.’ ‘We’re going to figure it out.’ ”

The Negotiations

With the bankruptcy sale process winding up, Lantern was suddenly confronted with 96 objections to the deal, including from Hollywood luminaries like Tarantino and Bradley Cooper, who said the company owed them millions. Asserting that he was misled about financial claims against the studio, Mitchell demanded a $46 million price reduction. Both sides threatened suits, and the closing date came and went.

Andy Mitchell and his company find once-distressed ventures and give them new life. Photo by Rodger Mallison

There were 4:30 a.m. phone calls and angry exchanges. But Lantern, not the creditors, negotiated from a position of strength. “They realized there was no one else in the world” willing to do the deal, Mitchell said. The Weinstein Co.’s negotiator disclosed in a court filing that it was running out of time and money. Meanwhile, Lantern scrutinized the 250 films for contractual land mines and jettisoned about two dozen because of potential problems.

Both sides eventually agreed to a $21 million reduction, with the Weinstein Co.’s consultants accepting $1 million less in fees. In the end, news reports said, Lantern paid creditors $289 million. With funds set aside for unresolved claims, the deal added up to $437 million, which meant Lantern had acquired the company for tens of millions less than Burkle’s public offer.

The Final Deal

The Weinstein Co.’s assets became Lantern Entertainment, a unit of Lantern Capital Partners. Nine months later, Lantern created a joint venture — Spyglass Media Group — with Hollywood veteran Gary Barber, MGM’s former CEO, running day-to-day operations and making major decisions in consultation with Mitchell and his team.

The Covid-19 pandemic has delayed a number of projects, but in pre-production are Scream 5, with Friends star Courteney Cox reprising her role as journalist Gale Weathers; an English-language remake of Perfect Strangers; and a feature film based on the 1980s hit series Knight Rider. Also in the works is Boys in the Boat, a co-production with MGM about working-class collegiate rowers from Washington competing in the 1936 Berlin Olympics. And Spyglass will oversee the 19th season of Project Runway.

Meanwhile, the acquired film library proved beneficial during the shutdown as Lantern sold more movies than expected to streaming platforms entertaining diversion-starved Americans. The Tiger Woods-designed residential golf development, Bluejack National, north of Houston, saw membership sales increase more than 15 percent during the first six months of 2020.

People who knew Andy Mitchell long before he entered the business world were not surprised by the headline-grabbing Weinstein acquisition. “When I heard about it,” Rusak said, “I remember thinking, ‘That’s the same guy I knew in high school and college — bold, creative and seeing opportunity.’ ”

Your comments are welcome

Comments

Related reading:

Alumni, Features

From ‘Twin Peaks’ to ‘Us,’ She Sets the Scene

Once a TCU soccer player, Ruth De Jong is a top Hollywood production designer.

Alumni, Features

Allie Beth Allman is a North Texas Real Estate Mogul

The Dallas real estate agent sells high-end homes and gives back to the community.

Alumni

Krys Boyd Gives Listeners Something to ‘Think’ About

The host of KERA’s Think radio show brings her unique journalistic style to a wide range of interviews.