Illustration by Mike McQuade

Leveling up

A fintech certificate from the Neeley School of Business positions students at the forefront of economic innovation.

During a blockchain class in fall 2022, Rose Hoang ’23 asked professor Kelly Slaughter about a new technology released earlier that week.

“He told us that ChatGPT looked like it has potential,” Hoang said. “In his next class, we had this whole discussion about it.”

Heralded as revolutionary within hours of its release, ChatGPT is a language-based artificial intelligence tool from OpenAI. The free platform works with Microsoft’s search engine, Bing, to answer questions and perform such tasks as writing emails or essays. It can even invent song lyrics in the style of anyone from Billy Joel to Billie Eilish.

Kelly Slaughter, the director of the business information systems program at the Neeley School of Business, was instrumental in creating TCU’s fintech certificate program after then-Neeley dean Daniel W. Pullin encouraged more fintech curriculum.

For someone pursuing a business career, ChatGPT can analyze data, identify market trends and improve customer service. The business applications are as limitless as the program itself.

“It was amazing to learn about this kind of technology in real time,” Hoang said.

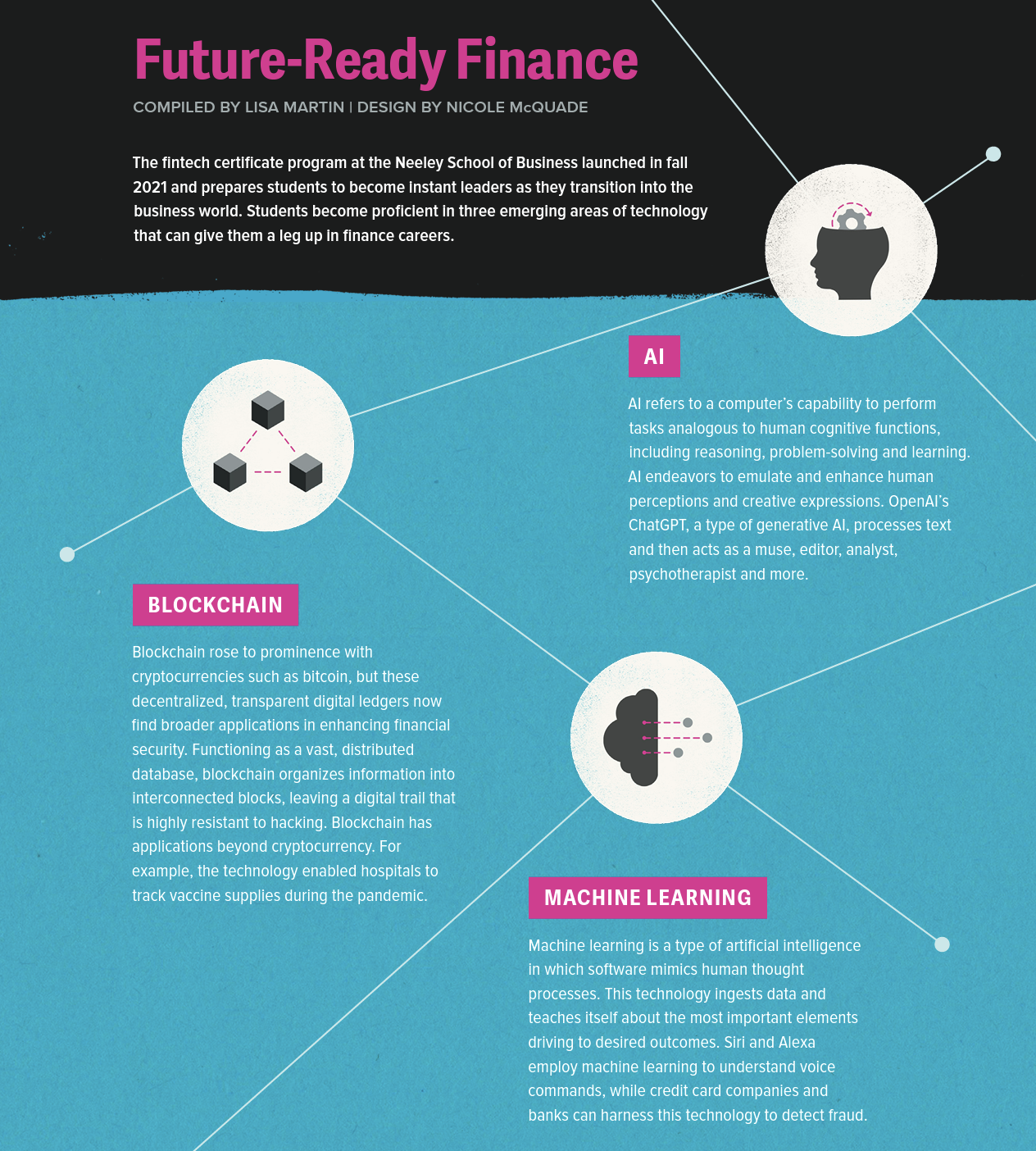

Embracing the latest technology is at the heart of the Neeley School of Business’ fintech certificate program. Around 150 students will have earned the certificate by May 2024 by completing three classes: blockchain, machine learning and AI (artificial intelligence).

As a finance major and first-generation college student from Vietnam, Hoang pursued the certificate to make herself more marketable to potential employers.

So, too, did Sam Eisenberg ’23, a graduate in accounting and finance.

“I want to find a way where I can leverage what I’ve learned in those classes with my new employer,” said Eisenberg, who began working as a financial modeling analyst at Origin Bank, a community bank in suburban Dallas, shortly after graduating.

“I feel like I can create value in my career in the domains of machine learning and AI,” he said, noting he’s the youngest in his office “by a wide margin.” He succeeded in fall 2023 in convincing the Mortgage Warehouse Lending team to create a model that predicts future loan and deposit balances. He is building multiple models, including, he said, one employing “the same algorithm that was utilized several times in the machine learning course.”

“There’s a lot of improvement to be made using AI as a predictive model rather than just relying on historical data,” he said. “What just happened in the stock market doesn’t fully explain or predict what it could do the next day.”

FINTECH EXPLAINED

A mashup of finance and technology, fintech has become better known in the last five years, though scholars and business leaders look to the first trans-Atlantic cable as the category’s true beginning.

Laid in 1866, that wire globalized financial markets by allowing European and North American commodities traders on both sides of the ocean to know the prices of coffee, grain, cotton and gold in a timely manner.

One hundred and fifty years later came the arrival of the third wave of fintech, an age in which machines do everything from making recommendations for certain stocks to writing corporate memos. Today, companies utilize mobile applications, machine learning, blockchain (public ledgers with digital distribution) and data analytics to improve efficiency in online banking, crowdfunding and more.

“Technology generally supports a firm by doing the same thing better or cheaper,” said Slaughter, director of the business information systems program at Neeley, who was instrumental in creating TCU’s fintech certificate program. He’s also a professor of professional practice in information systems and supply chain management.

Slaughter credits TCU President Daniel W. Pullin, back when he was the dean of the Neeley School of Business, with starting conversations about bolstering the fintech curriculum.

“Like many of the new, innovative initiatives across TCU, the roots of those ideas can really be attributed to the external environment,” Pullin said, noting that the business marketplace in Dallas-Fort Worth helped shape the new curriculum.

So, too, did the Neeley alumni on the fintech advisory council, who gave input on designing the curriculum. Council members include Diane Ellis ’88, senior managing director at IntraFi and former executive at the Federal Deposit Insurance Corp.; angel investor Aaron Grieshaber ’02; and Ed Koellner ’89 MBA, a senior attorney at USAA.

Students first began working toward the fintech certificate in fall 2021.

“In many ways,” Pullin said, “with this certification we are playing matchmaker between the aspirations of our students and the growing needs of our employers and community leaders.”

MACHINE LEARNING ON THE MARCH

To earn the fintech certificate, students must take a class on machine learning, an element of AI focused on the creation of the algorithms and models that allow computers to learn and make predictions on their own. Thanks to a variety of statistical techniques, computers can learn from large amounts of data, leading them to make accurate predictions.

“If you have a kid and you’re trying to train them to learn to ride a bike, you hold onto them and they start riding, then eventually you release them,” said Peter Obitade, assistant professor of professional practice in business information systems. “Machine learning is the same way. You train it to make predictions based on past data.”

TCU assistant professor Peter Obitabe said machine learning, in simple terms, is similar to teaching a child how to ride a bike. “You train it to make predictions based on past data,” he said.

When self-driving cars finally hit the market, they’ll be a product of machine learning. Sensors on a vehicle’s exterior will transmit data that will enable the car to navigate not just the rules of the road but also an ever-changing environment, whether it’s a quiet cul-de-sac or bumper-to-bumper traffic on the highway. Today, that little Roomba vacuum whizzing along floors uses machine learning technology to avoid getting tangled in cords and cables.

Machine learning also does everything from detecting credit card fraud to filtering spam emails. Virtual assistants such as Alexa and Siri, which understand questions and form responses, owe their existence to machine learning.

Obitade uses his experiences as a senior data engineering/analytics manager at Wells Fargo and Chevron Corp. to teach Neeley students how machine learning algorithms are being leveraged by financial institutions and banks to solve strategic business problems.

“You look for females from ages 25 to 49 who live in certain ZIP codes, and you look for predictions on the behavior of that group,” Obitade said, noting the data can help bankers anticipate everything from retail spending patterns to credit card applications from a given demographic.

Understanding the value of information in financial markets helps students better grasp what machine learning brings to the table. The class delves into Python, a popular programming language that has a reputation for simplicity. Python allows students to build advanced machine learning algorithms to predict everything from stock prices, to bank customer segmentation and targeting, to the performance of an initial public offering.

“We’re not going to be software engineers, but anyone who gets the fintech certificate knows the basics of coding, something that was brought up in my job interviews,” said Lucia Simovicova ’23, who came to Fort Worth from Slovakia to swim for TCU.

“The purpose of the fintech certificate is to make us middlemen where we know the business side of things and have a technical perspective,” said Simovicova, who now works as a technology risk consultant at the Dallas office of Ernst and Young.

BITCOIN, BLOCKCHAIN AND BEYOND

In fall 2022, Simovicova took the blockchain class, which focuses in large part on bitcoin, the world’s first cryptocurrency. Like the internet, bitcoin is an entity rather than a company or a nonprofit.

When he’s explaining bitcoin to students and others, Obitade refers to Investopedia’s definition: “Bitcoin is a cryptocurrency, a virtual currency designed to act as money and a form of payment outside the control of any one person, group or entity, thus removing the need for third-party involvement in financial transactions.”

Every bitcoin transaction appears on its open ledger. Nearly all bitcoin buyers, however, have pseudonymous usernames to mask identities.

A technology called blockchain makes bitcoin possible. Stanford Online defines blockchain as “blocks of data linked into an un-editable digital chain. This information is stored in an open-source decentralized environment, in which each block’s information is confirmable by every participating computer. It’s designed to have decentralized management instead of the traditional hierarchical systems.”

About the time Simovicova and her peers were taking their final exams, real life again intruded in the classroom when Sam Bankman-Fried, founder of the cryptocurrency trading firm FTX, was arrested in the Bahamas on fraud charges. On Nov. 2, he was convicted of seven counts related to multibillion-dollar fraud.

Bankman-Fried’s case sparked calls for tighter regulations on this growing segment of fintech. Skeptics worry, for example, that the use of pseudonyms in cryptocurrency transactions makes money laundering easier on a practical level and harder to detect.

But bitcoin has plenty of proponents.

“With blockchain, when people hear secure, they think hidden, they think encryption, they think like what happens to your credit card when it goes over the web, but it’s really not that at all. It’s actually quite transparent, and the way the math works, it’s almost impossible to hack.”

Kelly Slaughter

Eisenberg considers the blockchain class his favorite in the fintech sequence.

“Bitcoin is immutable,” he said. “People can’t go in and fudge the numbers or create false transactions because you’re going to have all of these other computers telling you what they believe is the current transaction and what the correct balances are at every single point in time.”

Proponents of bitcoin and other digital currencies also talk about the minimal fees associated with transactions, particularly those that cross borders. “If someone doesn’t have any faith in their currency, bitcoin is a great option because it’s so safe,” said Matt Minnis ’86 (MBA ’88), a member of Neeley’s fintech advisory board and former TCU basketball star.

“With blockchain, when people hear secure, they think hidden, they think encryption, they think like what happens to your credit card when it goes over the web, but it’s really not that at all,” Slaughter said. “It’s actually quite transparent, and the way the math works, it’s almost impossible to hack.”

His former student Simovicova is especially bullish on blockchain, which has applications that go beyond digital currencies.

“I’m not going to say it’s going to solve world hunger, but it could help a lot of people where governments are corrupt,” Simovicova said. “People could have their land titles on blockchain so that no one in the government could change records.”

She said blockchain technology can also make banking more accessible for people in poor or remote areas.

“Because of blockchain,” she said, “anyone who has a smartphone and a password has access to their money.”

AI COMES OF AGE

Artificial intelligence revolves around computer systems performing tasks that previously relied on human intelligence. AI can simulate human language, learning, problem-solving, reasoning and perception.

When someone finishes binge-watching a show on Netflix and sees recommendations for a new series, that’s AI in action. Video games in which characters adapt to player strategies? Also AI. The popular da Vinci Surgical System that helps guide an OB-GYN through a patient’s hysterectomy: Thank AI for unrivaled precision.

“Our students really need to leverage all of these new technologies, especially AI and machine learning, to improve financial and operational performance. It gives them a competitive edge.”

Peter Obitabe

“The difference between machine learning and AI is that machine learning isn’t trying to mimic human intelligence,” said Mary Jania ’23, who graduated in May with a degree in finance and will soon start a job as a management consultant for KPMG in Chicago.

“Being able to have a conversation about AI was a differentiator from other applicants,” she said. “It’s definitely a hot topic right now at a lot of big professional services firms.”

Anyone worried about AI leading to robots taking over the world — think HAL in Stanley Kubrick’s 55-year-old 2001: A Space Odyssey — should pump the brakes on the anxiety.

“The press is way ahead of reality when it comes to AI,” said Slaughter, who is excited to see the fruits of the immense collaborative opportunities between humans and AI.

In spring 2023, Jania and Eisenberg collaborated on a class project about how AI could improve financial well-being by helping American consumers understand credit card minimum payments along with budgeting, credit scores and more.

“Based on the data, we’re recommending launching seminars in high school,” Jania said. “Budgeting apps can also be a powerful tool.”

“Our students really need to leverage all of these new technologies, especially AI and machine learning, to improve financial and operational performance,” Obitade said. “It gives them a competitive edge.”

Your comments are welcome

2 Comments

TCU’s Neeley School of Business is diving deep into fintech with cutting-edge tech like ChatGPT and blockchain. They’re making complex topics like machine learning relatable, and real-world examples. The potential impact of blockchain, from incorruptible land titles to accessible banking, is revolutionary. And it’s awesome to see students using AI for projects that benefit society.

The discussion around Bankman-Fried’s case and its implications for fintech regulation is so timely, especially as cryptocurrencies continue to grow in popularity. The concerns about pseudonyms making money laundering easier are valid, yet it’s fascinating to hear proponents emphasize the transparency of blockchain technology. The point about bitcoin being immutable really highlights the potential for secure transactions that can’t be easily tampered with.

Simovicova’s insights into how blockchain can improve access to banking for underserved populations are particularly compelling. It’s amazing to think about how technology can empower individuals, especially in areas with corrupt governance.

I’m curious: how do you think the balance can be struck between necessary regulations to prevent misuse and allowing the innovative potential of cryptocurrencies and blockchain to flourish? Additionally, what role do you think education plays in helping the public understand and trust these technologies?

Related reading:

Features

Chief of Change

Grant Moise steers The Dallas Morning News into a new era.

Research + Discovery

Unwanted Inheritance

Mikaela Stewart’s research is geared toward disarming a deadly breast cancer gene.

Alumni, Features

The Soprano

Opera singer Vanessa Becerra hits a career high note.