Venture Capitalism 101

MBA students connect investors and startups in a Neeley program.

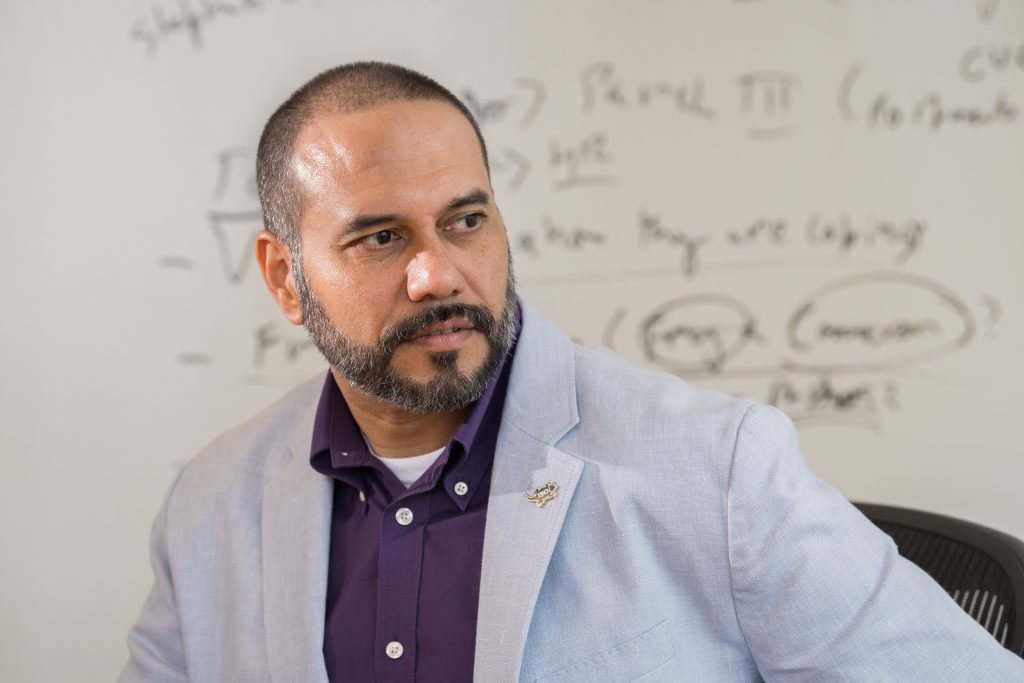

Since 2022, members of the Horned Frog Investment Network have made some $4.5 million in investments “We’re really just getting started,” Rodney D’Souza said. Photo by Leo Wesson

Venture Capitalism 101

MBA students connect investors and startups in a Neeley program.

Investors in the TCU community have new financial opportunities through the Horned Frog Investment Network.

Rodney D’Souza, managing director of the Institute for Entrepreneurship and Innovation, leads the investment network alongside program managers Andrew Hicks ’13 (MBA ’21) and Joe Dickerson ’11 (MBA ’20).

Founded in March 2022, the Horned Frog Investment Network brings together various stakeholders, including investors, startup leaders and Neeley School of Business MBA students, with the goal of funding select startups. While most members of the network have a direct affiliation to TCU, either as alumni or parents, others live in the Fort Worth community.

“We started the Horned Frog Investment Network to give people access to investment opportunities that they had traditionally not seen before when it comes to the venture capital/private equity space,” Hicks said. He teaches new venture development as an adjunct professor at Neeley and manages the investment network while also serving as a principal at RevTech Labs Capital, a North Carolina venture capital firm and accelerator that works with burgeoning fintech companies.

“A big part of that is connecting our network of investors with really high-quality opportunities around the country,” Hicks said.

Rodney D’Souza, the managing director of the Institute for Entrepreneurship and Innovation at TCU, leads the Horned Frog Investment Network along with alums Andrew Hicks and Joe Dickerson. Photo by Leo Wesson.

The network fills a need based in part on geography, D’Souza said.

“This part of the country — flyover country — obviously isn’t getting the attention that the coasts are,” D’Souza said, noting that epicenters for venture capitalism include California’s Silicon Valley, New York City, Seattle and Boston.

Horned Frog Investment Network membership affords access to events and educational opportunities. Most of all, it paves the way for select investment opportunities that MBA students have rigorously vetted.

Each year, the network hires two or three MBA students who are studying venture capitalism, D’Souza said. The students evaluate hundreds of companies to determine whether they’re a good fit for the investment network.

“There are very, very few schools in the country that have any sort of exposure to do real transactions in the venture capital world,” Hicks said, adding that the students “are basically given a massive leg up when it comes to entering the job market from both being prepared and having that true experience.”

In spring 2023 and based on the students’ recommendations, founders of three companies made pitches to a gathering of about 50 members of the network. Similar meetings happen several times a year.

“The students at TCU are getting in-class training of looking at deals, what are red flags and how do you overcome them, how to negotiate, all those kinds of things,” D’Souza said. “At the same time, community members who have an inclination and have the capital are also being trained on what to look for in deals, where to source them from.”

The Horned Frog Investment Network helps close a geographical gap between the coasts. “This part of the country — flyover country — obviously isn’t getting the attention that the coasts are,” Neeley associate professor Rodney D’Souza said. Photo by Leo Wesson.

Once those seeking funding step out of the room, the potential investors discuss the pros and cons of each opportunity. If a company inspires sufficient interest, the group schedules a deep dive to learn more in an hourlong meeting.

From there, members opt in only to what excites them.

One of the fintech companies that piqued the interest of network members was the Austin, Texas-based Spot Insurance, which specializes in embedded insurance. At the time of ticketing for anything from a flight to a ski pass, a consumer can check a box to add insurance to the trip’s total.

While raising $30 million in financing, representatives of Spot Insurance were invited to make a pitch to the Horned Frog Investment Network. Several network members took a chance on the startup, investing a total of $850,000 to $900,000.

“The technology that goes behind actually underwriting things like that at scale would blow your mind,” Hicks said.

Altogether, Horned Frog Investment Network members have made investments to the tune of $4.5 million since its inception.

“We’re really just getting started,” D’Souza said.

Your comments are welcome

Comments

Related reading:

Features

Leveling up

A fintech certificate from the Neeley School of Business positions students at the forefront of economic innovation.

Research + Discovery

Digital Safety Net

John T. Harvey recommends creating a Federal Cyber Insurance Corp., which would protect the U.S. from ransomware and other online crimes.

Features

Chief of Change

Grant Moise steers The Dallas Morning News into a new era.